40 zero coupon bonds tax

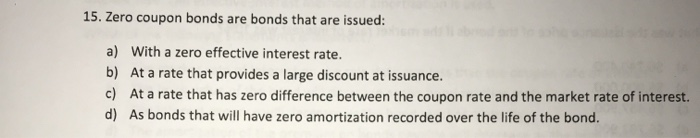

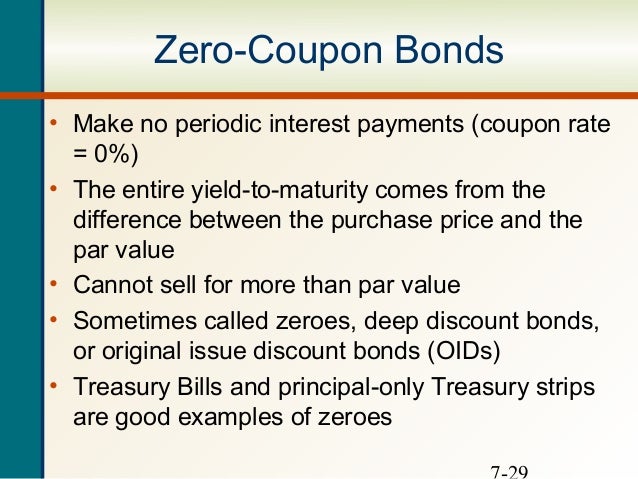

What Is the Coupon Rate of a Bond? Another type of bond is a zero coupon bond, which does not pay interest during the time the bond is outstanding. Rather, zero coupon bonds are sold at a discount to their value at maturity. Maturity dates on zero coupon bonds tend to be long term, often not maturing for 10, 15, or more years. Infrastructure Debt Funds - Tax Efficient Zero Coupon ... Background: On 6 April 2022, the Central Board of Direct Taxes has changed the Income-tax Rules, 1962, as amended (IT Rules) to enable infrastructure debt funds as companies ("IDFs") to issue zero-coupon bonds ("ZCBs").This provides IDFs more flexibility in procuring funds from domestic institutional investors encouraging increased investment in Indian infrastructure.

Understanding Zero Coupon Bonds - Part One You buy zero coupon bonds a deep discount to face value. You receive no interest until maturity; however, in most cases, you do owe taxes annually on the interest as it accrues. In Part Two In part two, we'll look more closely at the tax implications of zero coupon bonds and examine how you can use zeros to meet your financial goals.

Zero coupon bonds tax

› articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds Jan 31, 2022 · Zero-coupon U.S. Treasury bonds have a poor risk-return profile when held alone. Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run ... Calculating the cost basis on a tax free Zero Coupon Bond A tax free zero coupon bond is issued with a yield to maturity of 3.5%. After some time, an investor buys the bond at 50. ( 50 cents on the dollar ). When he buys the bond, the bond has a yield to maturity of 3.4%. After some time, he sells the bond for 80 cents on the dollar. Tax Treatment of Bonds and How It Differs From Stocks Corporate bonds have no tax-free provisions. You will pay taxes on any earnings from these debt securities. However, if they're held in a retirement account like a 401 (k) or IRA, you won't owe tax on their earnings until you withdraw them in retirement. 3 Zero-coupon bonds have specific tax implications.

Zero coupon bonds tax. money.usnews.com › investing › bondsHow Bond Maturity Works | Bonds | US News Mar 12, 2020 · Heckman says zero-coupon bonds have a longer duration than those that pay out coupons because zero-coupon bonds offer no income payments. ... Tax-free income remains a key benefit when it comes to ... What Is a Zero-Coupon Bond? | The Motley Fool Depending on the issuer, zero-coupon municipal bonds may generate tax-free imputed income, which means you won't have to pay tax until the bond matures -- usually many years in the future.... Letter Ruling 84-41: Zero Coupon Bonds Issued by Non ... Personal Income Tax June 25, 1984 You inquire as to the Massachusetts income tax treatment of zero-coupon bonds issued by non-Massachusetts municipalities. Holders of either corporate or government bonds issued after July 1, 1982, other than tax-exempt government obligations under I.R.C. § 103, must include in federal gross income the sum of the daily portions of original issue discount ... Zero-Coupon CDs: What They Are And How They Work | Bankrate You'll receive the full face value of the CD, plus all the interest, once it matures. Let's say you buy a 5-year, $100,000 zero-coupon CD at the discounted price of $88,000. You wouldn't receive...

smartasset.com › investing › how-to-buy-corporate-bondsWhat Are Corporate Bonds & Where Can You Buy Them? Nov 11, 2020 · Zero-Coupon Corporate Bonds. Whereas most corporate bonds include regular interest payments, zero-coupon bonds pay out solely on their final maturity date. In turn, you can usually buy them at a cheaper price. While a discount might seem desirable, the long-term style of zero-coupon corporate bonds leave them susceptible to volatility. What Is a Zero-Coupon Bond? Definition, Characteristics ... How Is the Income From a Zero-Coupon Bond Taxed? Despite the fact that zero-coupon bonds don't actually pay interest, bondholders are still subject to any applicable taxes on their imputed interest... Taxability of Zero Coupon Bonds - Income Tax I have a query regarding Zero Coupon Bonds Taxability. One of my relative had L&T Infra Zero Coupon Bonds 2011 series which matured this year and company deducted TDS under 194A. I had a query regarding it's taxability since these bonds were notified bonds and investment in them was eligible for deduction u/s 80CCF. › glossary › zero-coupon-bondZero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten ...

How Are Municipal Bonds Taxed? - Investopedia Zero-coupon municipal bonds, which are bought at a discount because they do not make any interest or coupon payments, don't have to be taxed. In fact, most aren't. As long as you're investing in a... Zero-Coupon Bond Value | Formula, Example, Analysis ... Zero-coupon bonds are popular for their several advantages, first of which is that investors generally only pay the capital gains tax. Should there be a large drop in the interest rate, investors no longer have to pay tax on interest, and that's because the bonds are purchased with a discount and redeemed at par value. Calculate after tax cost of debt on a zero coupon bond The Welch Corporation is planning a zero coupon bond issue. The bond has a par value of $1000, matures in 10 years, and will be sold at an 80% discount, or for $200. The firm's marginal tax rate is 40%. What is the annual. Best bonds to invest in India - Bondsindia When you are investing in bonds, whether it is a government bond, corporate bond, tax-free bond, or zero-coupon rate bond, it is essential for you to understand some points. Let us see them: It would be best to analyse the risk involved in the bond and what return they can provide. ...

Investing in Zero Coupon in India - Free Income Tax ... They are only subject to capital gains tax. Tax on Gains: How is income from these bonds treated? As mentioned above, investors of notified zero coupon bonds issued by NABARD and REC are liable to pay only capital gains tax on maturity. Capital appreciation in such cases is the difference between the maturity price and purchase price of the bond.

CBDT amends Income Tax rule 2F & rule 8B & release new ... CBDT amends Income Tax rule 2F, rule 8B and introduces new FORM NO. 5B - Application for notification of a zero coupon bond under clause (48) of section 2 of the Income-tax Act, 1961 and Form No. 5BA - Certificate of an accountant under sub-rule (6) of rule 8B vide Notification No. 28/2022-Income-Tax Dated: 6th April, 2022. MINISTRY OF FINANCE

What Are Treasury STRIPS? - Investment Guide - SmartAsset When stripping of Treasury bonds began, the government discouraged the practice due to concerns about lost tax revenues. However, in 1982 tax laws were modified to change tax treatment of zero-coupon bonds.The Treasury department then accepted stripping and also began issuing bonds electronically, without paper certificates or coupons.

Are Bonds Taxable? 2022 Rates, Types of Bonds, Tax ... With a zero-coupon bond , you buy the bond at a discount from its face value, don't receive interest payments during the bond's term, and are paid the bond's face amount when it matures. For...

Zero Coupon Bond Yield: Formula, Considerations, and ... Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows: =...

RBI orders five banks to list zero coupon bonds at "fair ... A zero-coupon bond is not an interest bearing security. Unlike other bonds, it does not pay interest regularly. These are issued at deep discounts to their face value and are redeemed at face value on the maturity date. For example, a Rs 100 face value bond maturing in 10 years could be issued at Rs. 55.

CBDT amends Income Tax rule 2F, rule 8B and introduces new CBDT amends Income Tax rule 2F, rule 8B and introduces new FORM NO. 5B - Application for notification of a zero coupon bond under clause (48) of section 2 of the Income-tax Act, 1961 and Form No. 5BA - Certificate of an accountant under sub-rule (6) of rule 8B vide Notification No. 28/2022-Income-Tax Dated: 6th April, 2022.

4 things to know about Series I savings bonds | Savings bonds, Money stories, Zero coupon bond

Zero Coupon 2025 Fund | American Century Investments Zero Coupon 2025 Fund - BTTRX $106.38 | 0.02% ($0.02) NAV as of 04/22/2022 Historical NAV FUND FACTS Expenses and Dividends Recent Distribution History Historical Distributions Morningstar As of 03/31/2022 Morningstar Rating ™

& Walsh | Tax Free Municipal Bonds | Portfolio Management HEADQUARTERS: Hennion & Walsh, Inc. 2001 Route 46 Waterview Plaza Parsippany, NJ 07054

Zero Coupon Bond Funds: What Are They? - The Balance A zero coupon bond fund is a fund that contains zero coupon bonds. Zero coupon bonds don't pay interest, but they are purchased at a steep discount and the buyer receives the full par value upon maturity. Zero coupon bond funds can be structured as a mutual fund or an ETF. Zero coupon bonds typically experience more price volatility than other ...

› ask › answersHow Are Corporate Bonds Taxed? - Investopedia Jun 14, 2021 · On the other hand, there are zero-coupon bonds that have tax implications. These bonds are sold at a deep discount, relative to other bonds as they do not pay any interest or coupons. At maturity ...

PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange ... 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund. US Treasury. Sector. 1.64%. distribution yield. As of 03/31/2022. 2.38%. 30-day sec yield. As of 05/12/2022.

How are Bonds Taxed Under the Income Tax Act? - Wint Wealth Zero-Coupon Bonds Zero-coupon bondholders are liable to only capital gain tax as they do not provide any interest income. However, these are issued at a discount. Hence, the difference is taxed as capital gain. 2. Market-Linked Bonds Market-linked bonds offer fixed interest, and the interest rates are linked to the index it is tracking.

Calculating the cost basis on a tax free Zero Coupon Bond Calculating the cost basis on a tax free Zero Coupon Bond A tax free zero coupon bond is issued with a yield to maturity of 3.5%. After some time, an investor buys the bond at 50. ( 50 cents on the dollar ). When he buys the bond, the bond has a yield to maturity of 3.4%. After some time, he sells the bond for 80 cents on the dollar.

Not All Bonds Are Created Equal: Choosing Between Individual Bonds and Bond Funds - Hennion & Walsh

Zero-Coupon Bond Definition - Investopedia The imputed interest on the bond is subject to income tax, according to the Internal Revenue Service (IRS). Therefore, although no coupon payments are made on zero-coupon bonds until maturity,...

Post a Comment for "40 zero coupon bonds tax"