43 present value of zero coupon bond calculator

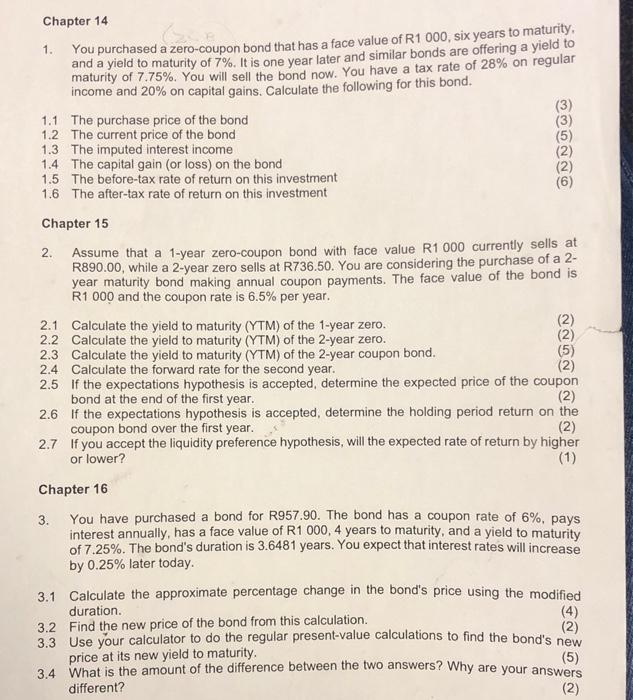

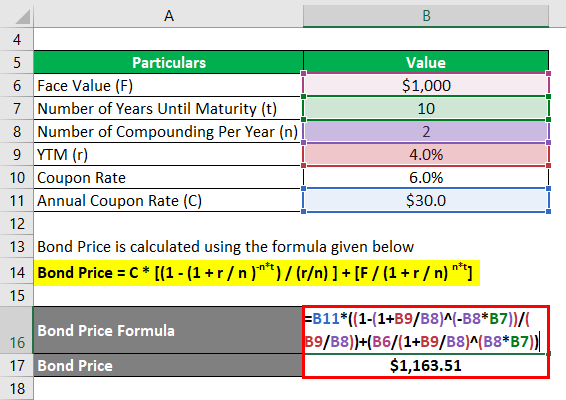

› calculators › bondpresentvalueBond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity. Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep Zero-Coupon Bond ; Formula · PV = Present Value; FV = Future Value; r = Yield-to-Maturity (YTM) ; Model Assumptions. Face Value (FV) = $1,000; Number of Years to ...

Zero Coupon Bond Value Calculator - StableBread Present Value and Future Value. Discounted Payback Period (DPP) Calculator · Future Value (FV) Calculator · Future Value Factor (FVF) Calculator ...

Present value of zero coupon bond calculator

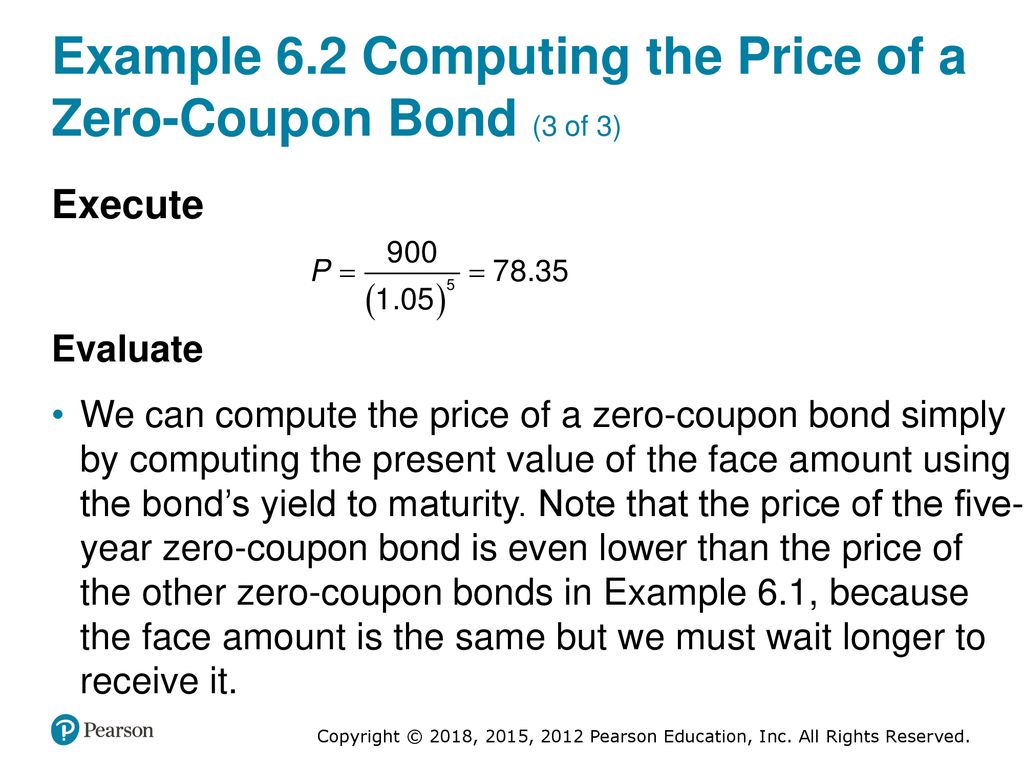

Bond valuation (Zero coupon bonds) |Calculator - Trignosource Zero-coupon bond pricing refers to finding out the fair value of a zero-coupon bond, which is simply the present value of the redemption amount of that bond ... How to Calculate Yield to Maturity of a Zero-Coupon Bond Instead, z-bonds are issued at a discount and mature to their face value. As a result, YTM calculations for zero-coupon bonds differ from traditional bonds. › Calculate-Bond-ValueHow to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow Apr 19, 2021 · If you use a table, you will locate the present value factor for a 4% discount rate for 5 years. That factor is .822. The present value of $100 is ($100 X .822 = $82.20). The present value of your bond is (present value of all interest payments) + (present value of principal repayment at maturity).

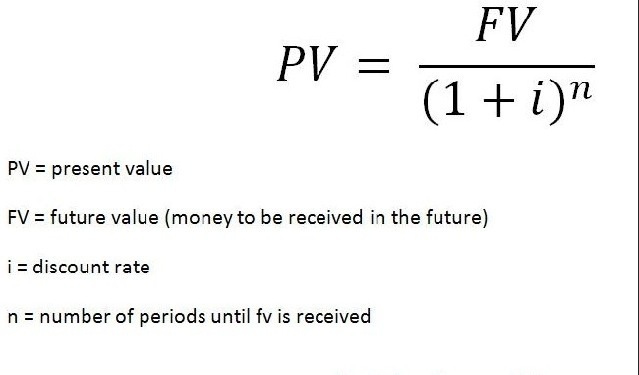

Present value of zero coupon bond calculator. › Zero_Coupon_Bond_ValueZero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F , 6% would be r , and t would be 5 years. After solving the equation, the original price or value would be $74.73. Calculate Zero-coupon Bond Purchase Price Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power ... nerdcounter.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator - Nerd Counter How to Calculate the Price of Zero Coupon Bond? The particular formula that is used for calculating zero coupon bond price is given below: P (1+r)t; Examples: Now come to a zero coupon bond example, if the face value is $2000 and the interest rate is 20%, we will calculate the price of a zero coupon bond that matures in 10 years. Zero Coupon Bond Value Calculator - BuyUpside.com The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield ...

dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Value? So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. › terms › bBond Valuation: Calculation, Definition, Formula, and Example May 31, 2022 · Bond valuation is a technique for determining the theoretical fair value of a particular bond. Bond valuation includes calculating the present value of the bond's future interest payments, also ... Zero Coupon Bond - Explained - The Business Professor, LLC Apr 17, 2022 ... Below is the formula for calculating the present value of a zero coupon bond: Price = M / (1 + r)^n where M = the date of maturity r ... dqydj.com › bond-pricing-calculatorBond Price Calculator – Present Value of Future Cashflows - DQYDJ Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures. Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value.

Zero Coupon Bond Calculator - MiniWebtool When the bond reaches maturity, its investor receives its face value. It is also called a discount bond or deep discount bond. Formula. The zero-coupon bond ... › Calculate-Bond-ValueHow to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow Apr 19, 2021 · If you use a table, you will locate the present value factor for a 4% discount rate for 5 years. That factor is .822. The present value of $100 is ($100 X .822 = $82.20). The present value of your bond is (present value of all interest payments) + (present value of principal repayment at maturity). How to Calculate Yield to Maturity of a Zero-Coupon Bond Instead, z-bonds are issued at a discount and mature to their face value. As a result, YTM calculations for zero-coupon bonds differ from traditional bonds. Bond valuation (Zero coupon bonds) |Calculator - Trignosource Zero-coupon bond pricing refers to finding out the fair value of a zero-coupon bond, which is simply the present value of the redemption amount of that bond ...

Post a Comment for "43 present value of zero coupon bond calculator"