41 coupon rate and yield to maturity

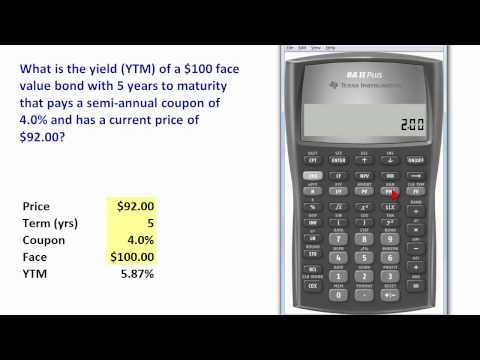

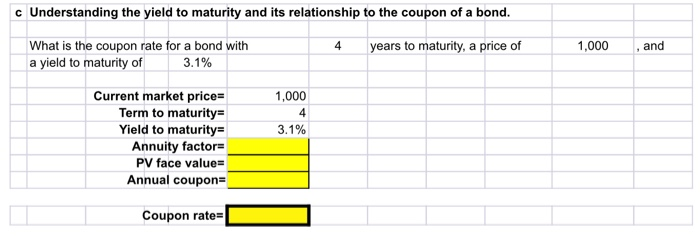

When is a bond's coupon rate and yield to maturity the same? A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. The par value of a bond is its face value, ... Bond Yield to Maturity (YTM) Calculator - DQYDJ On this page is a bond yield to maturity calculator, to automatically calculate the internal rate of return (IRR) earned on a certain bond. This calculator automatically assumes an investor holds to maturity, reinvests coupons, and all payments and coupons will be paid on time.

Yield to maturity - Wikipedia The yield to maturity (YTM), book yield or redemption yield of a bond or other fixed-interest security, such as gilts, is an estimate of the total rate of return anticipated to be earned by an investor who buys a bond at a given market price, holds it to maturity, and receives all interest payments and the capital redemption on schedule. It is the (theoretical) internal rate of return …

Coupon rate and yield to maturity

Difference between Coupon Rate And Yield To Maturity The primary difference between coupon rate and yield to maturity is that the coupon rate stays the same throughout the tenure of the bond. However, the yield to ... Yield to Maturity | Formula, Examples, Conclusion, Calculator Mar 24, 2021 · What is the yield to maturity rate? The approximate yield to maturity of this bond is 11.25%, which is above the annual coupon rate of 10% by 1.25%. You can then use this value as the rate (r) in the following formula: C = future cash flows/coupon payments; r = discount rate (the yield to maturity) F = Face value of the bond; n = number of ... Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a ...

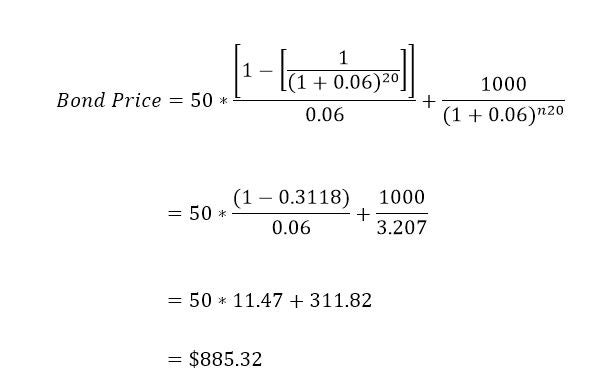

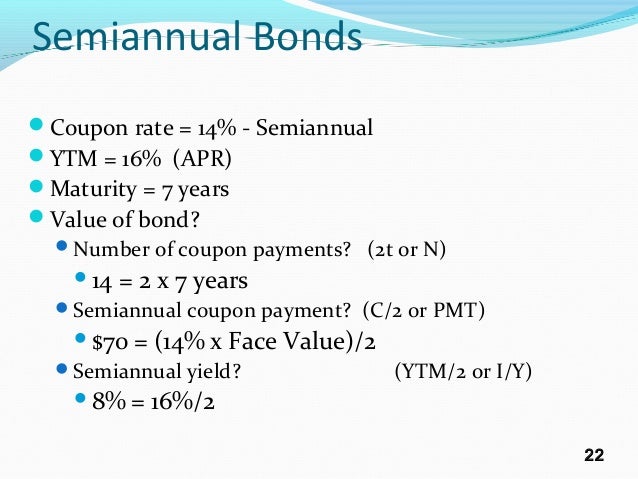

Coupon rate and yield to maturity. Yield to Maturity (YTM) Definition - Investopedia A bond's yield to maturity (YTM) is the internal rate of return required for the present value of all the future cash flows of the bond (face value and coupon ... How to calculate yield to maturity in Excel (Free Excel Template) 12.9.2021 · It cannot change over the life of the bond. The coupon rate is 6%. But as payment is done twice a year, the coupon rate for a period will be 6%/2 = 3%. So, pmt will be $1000 x 3% = $30. PV = Present value of the bond. It is the amount that you spend to buy a bond. So, it is negative in the RATE function. FV = Future value of the bond. Yield to Maturity (YTM): Formula and Excel Calculator Annual Coupon Rate (%): 6.0%; Number of Years to Maturity: 10 Years; Price of Bond (PV): $1,050; We’ll also assume that the bond issues semi-annual coupon payments. Given those inputs, the next step is to calculate the semi-annual coupon rate, which we can calculate by dividing the annual coupon rate by two. Semi-Annual Coupon Rate (%) = 6.0% ... Bond Yield to Maturity Calculator for Comparing Bonds Still, the term persists. The coupon is expressed as a percentage of the bond's face value. So, a 10% coupon on a $10,000 bond would pay an annual interest of $1000. Again, these payments are often staggered throughout the year, so a bond holder's interest might be paid in biannual or quarterly installments. Fixed Rate Bonds – A fixed rate ...

Learn How Coupon Rate Affects Bond Pricing 4 Mar 2022 — The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated ... The Difference Between Coupon and Yield to Maturity In short, "coupon" tells you what the bond paid when it was issued. The yield—or “yield to maturity”—tells you how much you will be paid in the future. Here's ... Coupon Rate Definition - Investopedia Sep 05, 2021 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

How to Calculate Yield to Maturity: 9 Steps (with Pictures) May 06, 2021 · Since this bond is priced at a discount, we know that the yield to maturity will be higher than the coupon rate. Since we know that the coupon rate is 5 percent, we can start by plugging numbers that are higher than that into the formula above to solve for P. [6] X Research source Yield to Maturity (YTM) Calculator Yield to Maturity Calculator is an online tool for investment calculation, programmed to calculate the expected investment return of a bond. This calculator generates the output value of YTM in percentage according to the input values of YTM to select the bonds to invest in, Bond face value, Bond price, Coupon rate and years to maturity. Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a ... Yield to Maturity | Formula, Examples, Conclusion, Calculator Mar 24, 2021 · What is the yield to maturity rate? The approximate yield to maturity of this bond is 11.25%, which is above the annual coupon rate of 10% by 1.25%. You can then use this value as the rate (r) in the following formula: C = future cash flows/coupon payments; r = discount rate (the yield to maturity) F = Face value of the bond; n = number of ...

Difference between Coupon Rate And Yield To Maturity The primary difference between coupon rate and yield to maturity is that the coupon rate stays the same throughout the tenure of the bond. However, the yield to ...

![[最も人気のある!] yield to maturity formula zero coupon bond 161022-Yield to ...](https://efinancemanagement.com/wp-content/uploads/2019/01/Coupon-Rate.png)

Post a Comment for "41 coupon rate and yield to maturity"