45 bond coupon interest rate

› Calculate-an-Interest-Payment-onHow to Calculate an Interest Payment on a Bond: 8 Steps Dec 10, 2021 · For example, if long term interest rates rise from 5% (the coupon rate also) when the bond was purchased, the market price of a $1000 bond will fall to $500. Since the bond's coupon is only $50, the market price must fall to $500 when the interest rate is 10% to be marketable. WHAT IS COUPON RATE OF A BOND - The Fixed Income A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment.

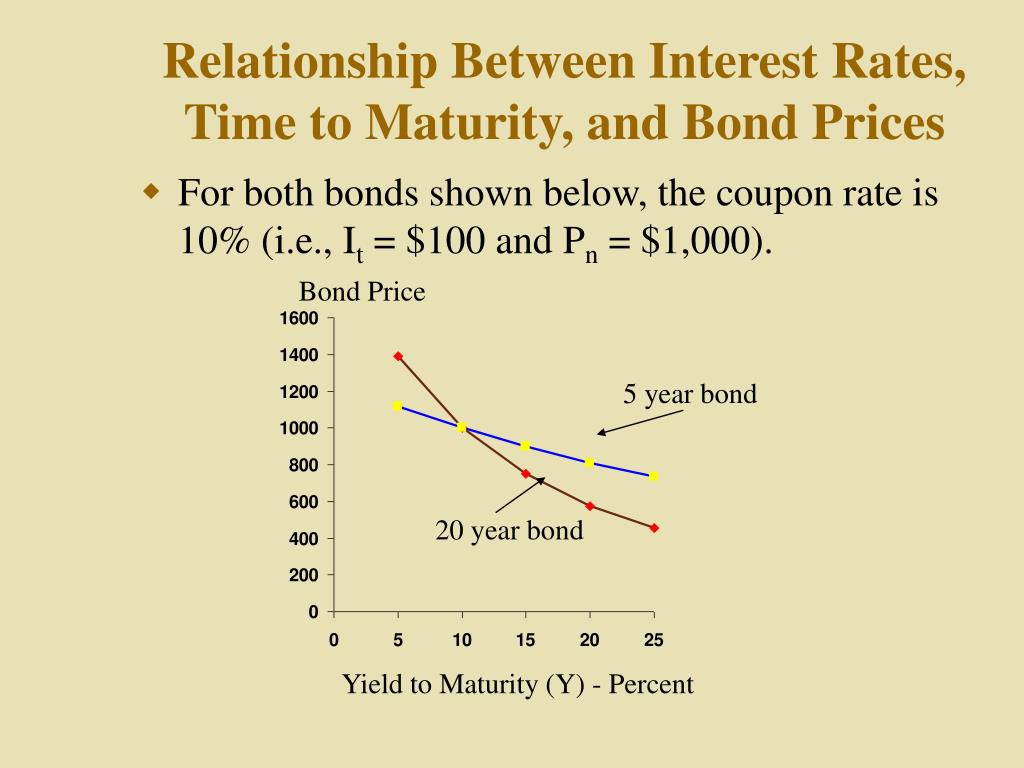

Bond Basics: How Interest Rates Affect Bond Yields When interest rates rise, prices of existing bonds tend to fall, even though the coupon rates remain constant: Yields go up. Conversely, when interest rates fall, prices of existing bonds tend to rise, their coupon remains constant - and yields go down. Quality matters. Not surprisingly, a bond's quality also has direct bearing on its price ...

Bond coupon interest rate

Fixing of coupon rates - Nykredit Realkredit A/S Effective from 12 July 2022, the coupon rates of floating-rate bonds issued by Nykredit Realkredit A/S will be adjusted. Bonds with quarterly interest rate fixing. The new coupon rates will apply ... Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment. ycharts.com › indicators › us_10year_government_bondUS 10-Year Government Bond Interest Rate - YCharts Mar 31, 2022 · US 10-Year Government Bond Interest Rate is at 3.13%, compared to 2.90% last month and 1.51% last year. This is lower than the long term average of 5.91%.

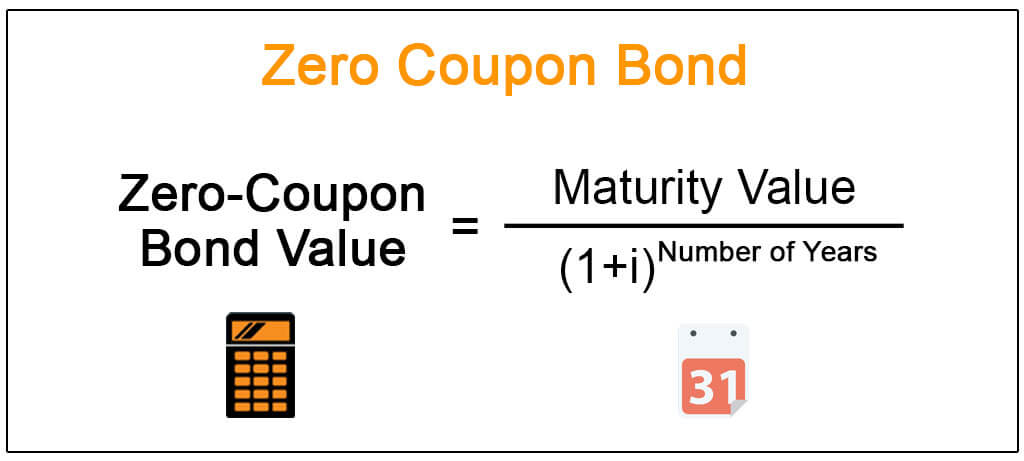

Bond coupon interest rate. Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding BONDS | BOND MARKET | PRICES | RATES | Markets Insider U.S. Rates 3 Months: 1.86 1.23%: 0.02: ... Bonds are interest bearing securities. Unlike shares, bonds are not traded in another currency, but instead in percent. ... The coupon shows the interest ... How to Calculate the Price of a Bond With Semiannual Coupon Interest ... 24.04.2019 · The required rate of return, financially speaking, is the rate you should "require" from your bond based on comparable investments that are available. The assumption is that it's pointless to invest in a bond if you can achieve an equivalent or better return with an alternative investment. For example, if there are bonds available in the ... 10-Year High Quality Market (HQM) Corporate Bond Spot Rate 10.06.2022 · Graph and download economic data for 10-Year High Quality Market (HQM) Corporate Bond Spot Rate (HQMCB10YR) from Jan 1984 to May 2022 about 10-year, bonds, corporate, interest rate, interest, rate, and USA.

U.S. Treasury Confirms I Bonds Will Pay A 9.62% Interest Rate With inflation increasing this year to multi-decade highs, I Bonds bought from May until Monday, October 31, will pay an annualized interest rate of 9.62%. Keep in mind that the 9.62% rate is an... What is a Coupon Value? Definition and Calculation The coupon rate does not affect the bond price, but market interest rates will move bond prices, affecting bond yields. When an entity issues a bond, for example, a 2-year, $1,000 bond with a coupon rate of 3.50%, the investors will receive $35 annually. Difference Between Coupon Rate and Interest Rate A coupon rate is an annual interest payment, which is provided by the bond issuer to the bondholder at the time of maturity. In the meantime, coming to the interest rate, it is the charges put on the payment by the lender to the borrower. Readers who read this also read: Difference Between Coupon Rate and Discount Rate Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value ...

Coupon Rate Definition - Investopedia 05.09.2021 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... What Is a Zero-Coupon Bond? - The Motley Fool Say you want to purchase a bond with a face value of $10,000, 10 years to maturity, and 5% imputed interest. To find the current price of the bond, you'd follow the formula: Price of Zero-Coupon... Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders. US 10-Year Government Bond Interest Rate - YCharts 31.03.2022 · In depth view into US 10-Year Government Bond Interest Rate including historical data from 1974, charts and stats. US 10-Year Government Bond Interest Rate 3.13% for Jun 2022 Overview; Interactive Chart; Level Chart. Basic Info. US 10-Year Government Bond Interest Rate is at 3.13%, compared to 2.90% last month and 1.51% last year. This is lower than the …

Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's...

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

budgeting.thenest.com › calculate-price-bondHow to Calculate the Price of a Bond With Semiannual Coupon ... Apr 24, 2019 · Therefore, the example's required rate of return would be 2.5 percent per semiannual period. To convert this to a coupon payment, or the amount of money you'd actually receive each period, multiply the face amount of the bond by the required rate of return.

Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate Also, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower's failure to repay the loan or meet debt obligations.

Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond.

How the Fed's rate increase may affect your bond portfolio Bond investors are watching as the Federal Reserve raises interest rates for the first time since 2018 to combat surging prices. Annual inflation rose by 7.9% in February, a new 40-year high ...

Bond derivatives - Australian Securities Exchange For each bond in the bond basket, ASX will take the best bid and best offer available in the market by reference to live market prices taken from bond trading venues as determined by the Exchange. The average of the best bid and best offer for each bond will be calculated at 9:00am, 9:45am, 10:30am and 11:15am.

Bond Basics: Issue Size and Date, Maturity Value, Coupon Coupon and Yield to Maturity . The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures.

Post a Comment for "45 bond coupon interest rate"